Table of Contents

Suppliers that uncover the susceptability might produce patches or recommend workarounds to mitigate it though individuals require to deploy that mitigation to get rid of the vulnerability in their systems. Zero-day attacks are extreme risks. Potential attack vectors for a zero-day susceptability correspond known susceptabilities and those that have available patches. t1b: A manipulate ends up being active. t2: A lot of vulnerable systems have actually used the patch. Therefore the formula for the size of the home window of susceptability is: t2 t1b. In this solution, it is always real that t0 t1a, and t0 t1b. Note that t0 is not the exact same as day no.

For typical susceptabilities, t1b > t1a. This implies that the software program supplier was aware of the vulnerability and had time to publish a security spot (t1a) before any cyberpunk could craft a workable manipulate (t1b). For zero-day exploits, t1b t1a, such that the manipulate ends up being active before a patch is offered.

It has actually been recommended that an option of this kind might be out of reach due to the fact that it is algorithmically impossible in the general situation to analyze any kind of arbitrary code to determine if it is malicious: as such an evaluation decreases to the halting problem over a linear bounded robot, which is unresolvable.

3 Easy Facts About Security Consultants Described

The majority of contemporary antivirus software program still utilizes signatures but additionally performs various other sorts of analysis. [] In code evaluation, the machine code of the data is analysed to see if there is anything that looks dubious. Usually, malware has particular behaviour; code evaluation attempts to discover if this exists in the code.

An additional limitation of code analysis is the time and resources available. In the affordable globe of anti-virus software, there is always an equilibrium in between the performance of analysis and the time hold-up included.

This can be orders of size quicker than assessing the same code, however have to resist (and detect) attempts by the code to identify the sandbox. Generic signatures are trademarks that specify to specific behaviour as opposed to a certain thing of malware. Most brand-new malware is not completely unique, however is a variation on earlier malware, or contains code from several earlier instances of malware.

Fascination About Security Consultants

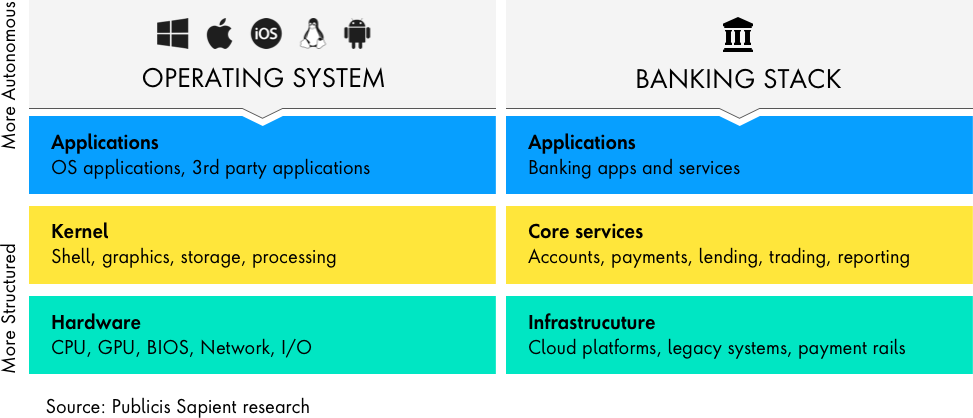

Held in a safe and robust cloud setting, Our state-of-the-art, scalable remedies are made to speed up innovation and aid banks supply the experiences customers require currently and in the future. We provide public and private hybrid cloud organizing solutions, with releases both in our very own completely repetitive and highly available information centers based in the United States, as well on the AWS public cloud, operating 24-hour a day, 365 days a year, under one of the most extensive quality and security requirements.

The money conversion cycle (CCC), also called the web operating cycle or money cycle, is a statistics that shares, in days, exactly how long it takes a company to transform the cash money invested in stock back into cash money from selling its item or service. The much shorter the cash cycle, the far better, as it shows less time that cash money is bound in receivables or stock.

This metric considers just how much time the company needs to offer its inventory, just how much time it takes to collect receivables, and just how much time it has to pay its costs. The CCC is among a number of measurable procedures that aid evaluate the performance of a firm's operations and monitoring.

Banking Security Things To Know Before You Get This

One need to remember that CCC uses just to select fields depending on stock management and relevant operations. The money conversion cycle (CCC) is a statistics that expresses the size of time (in days) that it considers a firm to convert its financial investments in inventory and other resources into capital from sales.

g., year = 365 days, quarter = 90) The initial stage concentrates on the existing stock degree and represents for how long it will certainly take for the company to offer its supply. This figure is computed by utilizing the days supply exceptional (DIO). A lower worth of DIO is chosen, as it indicates that the company is making sales swiftly, suggesting better turn over for business.

Inventory=21(BI+EI)BI=Beginning stock, EI=Finishing stock The 2nd phase concentrates on the present sales and represents how much time it requires to collect the cash money generated from the sales. This number is determined by making use of the days sales impressive (DSO), which splits ordinary balance dues by profits each day. A reduced worth is chosen for DSO, which suggests that the business is able to collect capital in a short time, subsequently improving its cash position.

Unknown Facts About Banking Security

Accounts Receivable=21(BAR+EAR)BAR=Start AREAR=Ending AR The 3rd phase focuses on the present impressive payable for business. It thinks about the amount of money that the business owes its current vendors for the stock and products it acquisitions, and it stands for the duration in which the firm have to repay those responsibilities.

Boosting sales of supply commercial is the key means for a business to make more profits. How does one sell much more stuff? If cash money is conveniently readily available at routine periods, then one can produce more sales for earnings, as constant availability of resources causes more products to make and market.

Cash isn't an element until the firm pays the accounts payable and accumulates the accounts receivable. CCC traces the life cycle of money utilized for business task.

Examine This Report on Banking Security

CCC might not give significant inferences as a stand-alone number for a given duration. Analysts use it to track an organization over numerous period and to contrast the company to its competitors. Tracking a firm's CCC over multiple quarters will certainly show if it is improving, keeping, or aggravating its functional effectiveness.

Navigation

Latest Posts

Diy Plumbing near me Gilbert, Arizona

Should I Plumb My Own Home close to Gilbert, Arizona

Diy Plumbing close to Gilbert